Wyoming Statutory Trust vs. Delaware Statutory Trust

Asset protection isn't easy, especially if you are a California-based real estate investor. The good news for you is that LLCs aren't your only option. A Wyoming Statutory Trust, for example.

Using LLCs is a last resort for the California investor when looking for comprehensive asset protection. The $800 per year franchise taxes probably make a non-starter for you as you seek to compartmentalize every asset you own.

Does this sound like you?

The truth is that you don't need LLCs for protection in California. Also, you can use trusts that function just like traditional LLCs and Series LLCs. That's important as a real estate investor because these trusts provide:

- protection

- anonymity of ownership

- relief from the California franchise tax

To protect real estate investors like yourself, you might consider reliable and proven options, like the Wyoming Statutory Trust and the Delaware Statutory Trust.

Read on so you can evaluate the Wyoming vs. Delaware Statutory Trust, then decide which one is right for you.

Wyoming Statutory Trust: A Unique Tool for Savvy Investors

The Wyoming Statutory Trust and Missouri Statutory Trust function like LLCs, but they are trusts.

If you use the Wyoming Statutory trust for protection, you can:

- create an individual trust for every single property that you own

- they are individually asset protected just as if you held them in an LLC

Since you create these trusts with anonymity through the use of a nominee trustee, you can anonymously own both:

- your trust

- the underlying asset(s)

We recommend using an attorney to create the Wyoming Statutory Trust. Your attorney should also serve as the nominee trustee to ensure your anonymity. Your attorney protects you and your trust with attorney/client privilege as a trustee.

Valuable Evaluation of Pros and Cons

The Wyoming Trust may be the right trust for you if you have fewer properties or have no plans to grow.

The upsides to the Wyoming Statutory Trust include:

- they are inexpensive

- provide effective protection

Wyoming privacy laws do not require the registration of trust agreements. That means privacy about you, your family, assets, and your estate plan.

You should be aware of the limitations of the Wyoming Statutory Trust. The main issue with the Wyoming trust is the complexity it adds to scalability. It may turn out that this trust proves too complex and expensive to provide the proper protection for you.

The first is management. Management of each trust requires:

- its bank account

- set of accounting books

- dedicated attention to each trust

You would have a multitude of entities that may each require their tax reporting and filing. The amount of reporting on the entities can be an operational nightmare as you grow.

The second limitation deals with scalability. As you scale, you will be financially responsible for:

- costs of the creation of an additional trust

- operational complexities of banking and accounting

- tax preparation and filing costs

What follows is more information to help you decide on the merits of the Wyoming Statutory Trust vs. Delaware Statutory Trust.

Delaware Statutory Trust: Proven Asset Protection

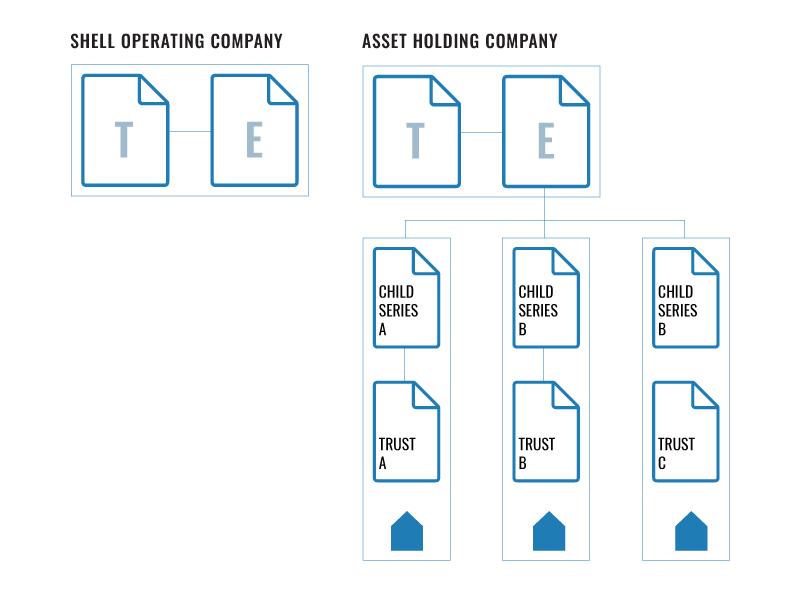

The Delaware Statutory Trust functions like a Series LLC, but it is a trust. That means the Delaware Trust might be for you if you have multiple properties to protect and you have plans to grow your business.

The Delaware Trust allows you to:

- create a single trust

- produce an infinite number of free children for your trust

- compartmentalize and own your company properties anonymously

An attorney is acting as nominee trustee and masks the actual ownership.

Promising Security from Delaware's Trust

The upside to the Delaware Statutory Trust includes:

- infinite scalability for free,

- streamlines your tax, bookkeeping, and banking into a single entity (the parent Delaware Statutory Trust)

The trust allows you to scale freely without additional operational complexity or tax filings.

Everything in your life should stay precisely the same as if you managed everything through a single entity that you wholly owned.

The primary downside is that the Delaware Statutory Trust cannot hold any active businesses such as typical commercial businesses, and you cannot "flip" your investments.

The limit on commercial businesses and the inability to "flip" properties may not fit your specific situation. Still, the Delaware Trust is a solid option in many investing cases.

We know the decision is an important one for you to make. Read our "Step-By-Step Statutory Trust Beginner's Guide" for more information.

The Bottom Line: Wyoming Statutory Trust vs. Delaware Statutory Trust

The Wyoming Statutory Trust is an excellent option if you have a single asset and don't plan on acquiring more.

If you are an investor with intentions to scale, then the additional upfront costs of a Delaware Statutory Trust will pay dividends in the long run.

You want to protect your assets and ensure your financial freedom. Let us help you! Register for FREE Royal Investing Group Mentoring on Wednesdays at 12:30 pm EST to learn more.