Real estate investing is an excellent way to put your money to work. The returns consistently outperform traditional savings and common investment vehicles, with little risk and low management.

There's only one problem. We live in the most litigious society on earth. Did you know one in four U.S. citizens will be sued in their lifetimes? Real estate investors face an even greater risk of lawsuit.

For years, the wealthy and powerful have shielded their wealth within layers of anonymous companies. Now you can do the same. The Series LLC is one of the central legal structures in any asset protection plan. Let's look at the benefits of using one.

A Traditional Limited Liability Company Isn't Enough To Protect Your Assets

Property in your name leaves you open to losing it all: Litigation doesn’t even have to have anything to do with your property in order to wipe you out. If you have property in your name, or even worse, in a general partnership, and are found liable in a car wreck or other random accident, you could lose everything. Insurance is not going to stop a plaintiff from going after anything and everything you own to repay damages for extensive hospital bills or a wrongful death action.

Property in a traditional LLC or corporation isn’t much better. You are in a little better shape if you have all your assets in one traditional LLC or corporation. In that case, lawsuits against you personally can’t normally touch your business assets. But if you have all your assets in one LLC, and there is a slip and fall at one of your properties that results in serious injury or death, a plaintiff can go after all your properties. It doesn’t matter that your other properties are unrelated to the incident.

Insurance Won't Protect Your Investments

Insurance can help with minor incidents, but it’s not going to save you from losing everything in the case of a big, catastrophic lawsuit. If someone falls through your stairs and the court finds you are at fault because of the nature of the structure or maintenance, your insurance will likely not cover you at all. And certainly, neither your property nor your automobile insurance will cover you if you are found negligent in a serious accident.

The one thing that can save you from disaster is setting up an LLC Series and Anonymous Trust. Plaintiffs can never reach all of your assets because they are owned by separate legal entities and never in your name.

How the Series LLC Structure Protects You

1. Compartmentalizes Your Risk

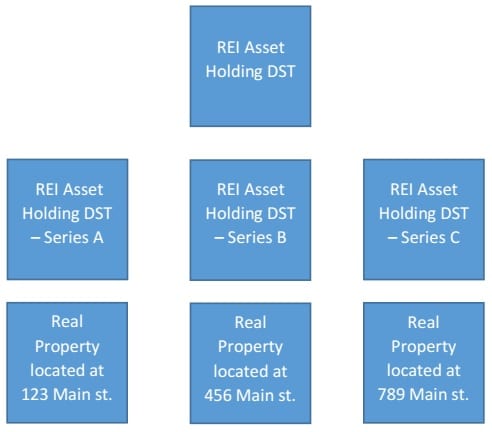

Setting up an LLC Series Structure legally isolates your equity into separate limited liability companies inside a holding company. Even if you lose a lawsuit, the damage is limited to a single property or asset within the individual series.

The Series LLC works for multiple types of investments. It's great for property management but is equally effective at protecting other investments like a stock portfolio.

2. Hides Your Assets

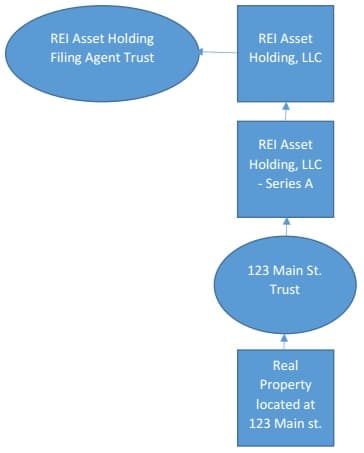

In a Series LLC, your assets are each separated into individual entities. You can add an anonymous trust to each of these entities for further protection.

Limited liability companies and other business entities are exposed to the public. Anybody can look up your company name and see what type of assets it contains. Trusts, on the other hand, do not need to list their holdings publicly. When combined with the Series LLC, it makes all of the individual holdings essentially invisible. The anonymous trusts own the LLC itself and serve as title trusts for the real estate asset.

How a Series LLC Protects You From Lawsuits

There are three pillars of any lawsuit: opportunity, incentive, and the judgement. Winning a judgement requires a good lawyer, a friendly judge or jury, and a little luck. Clearly, that isn't the pillar we want to focus on. Instead, asset protection strategies target opportunity and incentives.

1. Plaintiff Attorneys Can't Sue What Isn't There

An accident on your property plants the seed of opportunity, but it isn't enough to kick off a lawsuit. In order to put things in motion, the lawsuit attorney must be able to sue you.

An anonymous Series LLC can remove this opportunity in two ways.

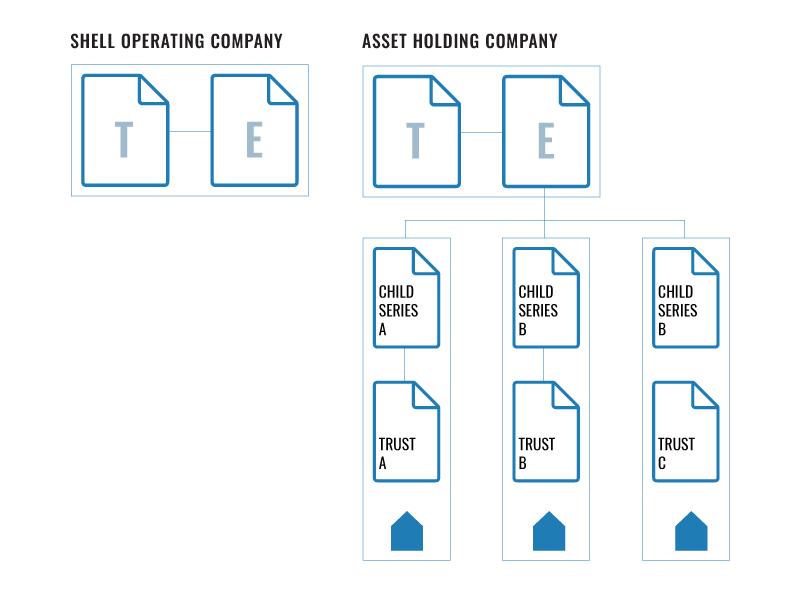

Using a Shell Company: Did you know you can break your company into two separate companies? The first is an asset holding company, which isolates assets into individual entities. The second is an operations company, which manages the day-to-day affairs. With some minor adjustments to your contracts, you can require all lawsuits to be brought against the operations company. This acts as a shell company, which means even if you lose the lawsuit there is nothing of value to be lost.

Using Trusts: As mentioned previously, hiding your assets within trusts means your assets are invisible. Even if you could be sued, your opponent's legal team won't be able to find which company to bring the case against. This dramatically reduces the opportunity to bring a lawsuit against you, even if there was some event that could be used as justification for doing so.

2. Attorneys Won’t Gamble or Chase the Money

Not only does a series LLC structure legally protect your assets, because your equity is in multiple legal entities, but it also discourages most lawsuits from ever being filed. Attorneys will not take a case unless they know how they will get paid. If equity is held in multiple LLCs set up with anonymous trusts it will appear on a search that you own very little – if anything at all. Attorneys will look elsewhere for an easier payday.

Plaintiffs need to pay at least $5,000 to even start litigation, and the amount quickly escalates to over $10,000 once discovery starts. It simply does not make sense for a plaintiff to file a lawsuit when they cannot find any assets that can be seized if they win a damage award.

Series LLCs Let You Grow Your Business Forever

With the Series LLC structure, there's an operating company on top, and multiple companies beneath. We use the metaphor of "parent-child" relationships to make the point that this structure lets you have as many "kids," or Series, as you like.

Each Series is its own LLC, and you can create new ones easily as you acquire more investments or other assets. As a bonus, you save money by using a Series LLC rather than the same amount of Traditional LLCs. You pay the costs of establishing the LLC once, and only once.

Series LLCs Protect Your Valuable Assets

The Series LLC's structure isolates your assets, allowing you to have full liability protection for each one. Each asset is secured in its own Series, which functions as its own LLC.

In practice, using a Series LLC makes you very difficult, or at least highly impractical, to sue. Even if someone has a good reason and the resources to sue you, their attorney may not want to. Why? The reasons are pretty simple:

- Anonymity protects you as an individual and keeps your name off of the assets. Without a name, it's impossible to sue you personally. Suing the assets is possible, but more difficult.

- Isolated assets mean only one asset is ever vulnerable at a time--the rest of the structure is immune to litigation.

- Asset protection strategies in general make that sole asset someone wants to sue you over not that worthwhile. Attorneys don't like to take cases if there's not a prize (in the form of cold, hard cash, or a valuable asset) worth fighting for.

This is just the quick and dirty version. See our previous article on how the Series LLC prevents lawsuits to learn more.

Series LLCs Offer Great Tax Benefits

That's right, even Uncle Sam is kind to the Series LLC. We could write a whole article on tax benefits alone, but here are our top two.

1. Save on Business Taxes

The Series LLC is represented only in its "home state." This means, if your Series LLC is formed in a state with no sales tax, you get to skate on sales tax. For real estate investors, this means rental payments between Series aren't subject to sales tax.

The beautiful part is, you don't even have to reside in the state you form the Series LLC in. If you're itching to save on taxes, consider the Texas Series LLC. This entity will also help you save money via pass-through taxation.

2. Simplify Your Tax Returns

Even though you can have as many Series and assets as you want, you'll still only file one tax return for the whole shebang. The operating company, or parent company, is the only one that you're required to put on the form. Of course, you're still paying taxes on the "children" (Series), but it's all reported as a single entity.

Is There a Catch?

Setting up LLC protection for your real estate business is fast, cost-effective, and scalable. You can be fully protected inside of only a week! There is a one-time set-up of the series structure for the limited liability company. Then you simply purchase a title transfer for each property you want to move within the asset protection vehicle.

There is no more work for your accountant with a series LLC. Though there are separate legal entities, there is a holding company LLC which is owned by an anonymous trust. This means there is still just one tax return, one LLC filing, one EIN, and one operating agreement. After it is set up, you won’t even notice it’s there in your normal course of business.

Setting up the initial structure is inexpensive considering the massive protection you will get and its infinite scalability. You can sleep better knowing your real estate investments and passive income have full asset protection with an LLC series structure and anonymous trusts.