Tech industry professionals thrive on innovation, cutting-edge technology, and rapid growth.

However, navigating the world of personal finance requires a different set of skills.

Whether they're W2 employees or entrepreneurs, experienced tech professionals can earn lucrative compensation packages, which unfortunately means significant tax liabilities. That’s why they have to optimize tax strategies and get professional help navigating complex tax laws.

Or if they own a business or have exited a business, our capital gains page can help (if they made a ton of money in their exit and are looking for tax strategies to offset that).

The unique financial challenges faced by tech workers call for tailored tax, investing and legal strategies to help you make the most of your wealth. These include:

✅️ Investing in cash flow deals (like algorithmic trading). ✅️ Creating a 501(C)3 Non-Profit Private Foundation to shelter up to 30% of your income ✅️ Setting up an S-Corporation for any side gigs and leverage the Augusta Rule |

Navigating the world of taxes can be daunting, especially for tech workers with complex compensation packages, stock options, and freelance gigs. With the right strategies, however, you can make an informed decision about the best steps to take to secure your financial future.

Let’s get started.

Equity compensation, a high income, remote work (where your employer is in another state with different laws) … These can make tax planning for tech professionals quite complex.

You have to take a lot into account.

Different types of equity compensation have different tax treatments. For example, Restricted Stock Units (RSUs) are taxed as ordinary income upon vesting. Incentive Stock Options (ISOs) may qualify for preferential tax treatment if certain holding periods are met. Non-Qualified Stock Options (NSOs) are taxed as ordinary income upon exercise. But exercising ISOs can trigger Alternative Minimum Tax (AMT) liability.

Lost yet? It can get pretty confusing very quickly.

I believe a solid wealth management strategy starts with tax planning. Remember: salaried (full-time) tech workers are taxed on gross income first, with the IRS taking their cut before you receive your paycheck.

Compare this to business owners and investors (with the correct structures in place), who pay the IRS quarterly on their net income after expenses.

When you (as a full-time employee) invest through a properly structured entity, your investment income gets the same tax treatment as a business. This allows you to use your money before deducting taxes.

Tech professionals early in their careers may benefit from Roth conversion strategies, paying taxes now on traditional retirement accounts to enjoy tax-free growth and withdrawals in the future. This isn't nearly as strong as the foundation or depreciation deals, however.

But if you’re like most of our clients, you’re further along in your career, making a good salary, and you've been told there isn't much you can do to lower your taxes beyond taking deductions or using retirement vehicles like 401ks and IRAs.

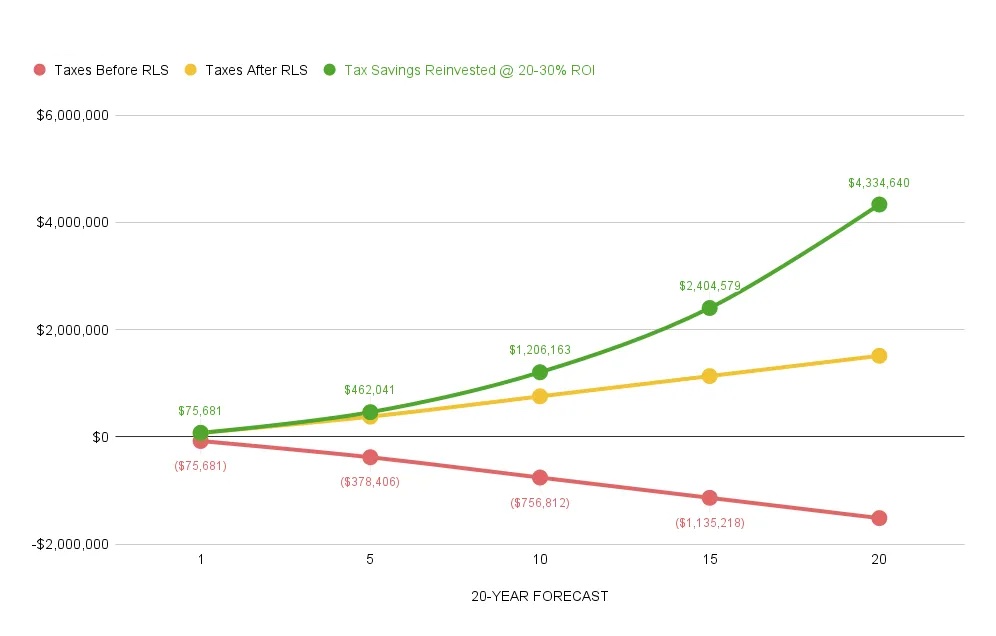

High earners in the tech field spend years growing their career and growing their income. The more they make, the more it hurts to see 20-30% of earnings yanked away by the IRS.

I have good news for you: The right CPA can show you how to layer tax strategies to dramatically cut your taxes and even reach the 0-10% range, depending on how aggressive you decide to go.

(Here's the catch: To achieve 0-10%, you actually have to implement all the tax strategies. That's like eating your veggies, nobody wants to do it.)

Many CPAs don’t understand that it's possible to save outside the standard deductions. Things like tax-loss harvesting can offset gains and reduce tax liability. Charitable giving or even setting up a private nonprofit foundation can also help.

A high-level CPA will be able to help you navigate complex tax decisions and make it seem easy. They can find creative (but completely legal) ways to save taxes. And that savings can be invested in equally creative, equally overlooked ways.

Such as …

After implementing all the best tax strategies, our tech clients then focus on investing their tax savings into tax-advantaged deals. There are tons of deal types, but there are two categories of investments you really need to know about:

Tech pros need to know about e three "financial freedom" strategies they can avail themself of:

The first two are short-term strategies. You can save taxes with Royal Legal's tax strategies (and you may still use a foundation, but only as one of many tools to capture tax savings) and you can generate cash flow with something like algorithmic trading.

Creating a nest egg requires a longer-term strategy. Putting money into your own foundation, THEN investing in cash flow deals is the strongest possible move—as long as you don't want to have a bunch of cash on hand. Because once it's in the Foundation, it's no longer yours. We endorse this strategy because that's the best possible move for anybody interested in achieving financial freedom.

Software executives, Saas founders, and other tech professionals have giant targets on their back when it comes to frivolous lawsuits.

All it takes is a car accident, an injury on your property, or a contractual disagreement—and once somebody knows what you own, they can hire a good attorney to pressure you until you settle out of court.

The way you prevent this is to set up asset protection before you get sued.

Anonymity across all of your entities and assets is key. Holding companies are where you should place your assets. This could be things like real estate properties or other investments. Anything of value that could be exposed during a lawsuit is important to protect. Operating companies run everything.

So here's what you'll be doing:

This is what "holds assets," typically anonymously. There are three kinds:

This is what does your "operations." Collecting rent, paying bills, performing key functions and transactions. This is what turns into the S-Corp because the money is flowing through (but not held inside for very long) this entity, which allows us to apply tax strategies to it.

In this case, you are mixing both. So you would want to differentiate…

Entity structuring means creating LLCs so your assets are held anonymously and separate from your high risk business transactions. We recommend a holding company for any investments or assets. Then a separate operating company for business transactions, such as your consulting side gig. When the operating company reaches $75k/year income, you should turn it into an S-Corp. etc…

PS - The $75k range (sometimes as low as $50k) is basically where you start to save money on taxes.

The reason it takes until then is that the S-Corporation requires a separate tax return and payroll, which both cost money in the $1-2k range. So it doesn't really pay for itself until a certain income threshold.

Unlike C Corps (that face corporate taxes and then shareholder taxes on dividends), S Corps allow shareholders to pay taxes only at their individual income tax rates, simplifying the process. S Corps split profits into wages and distributive shares, the latter of which is not subject to self-employment taxes. This distinction can provide considerable savings on the Social Security and Medicare tax burden.

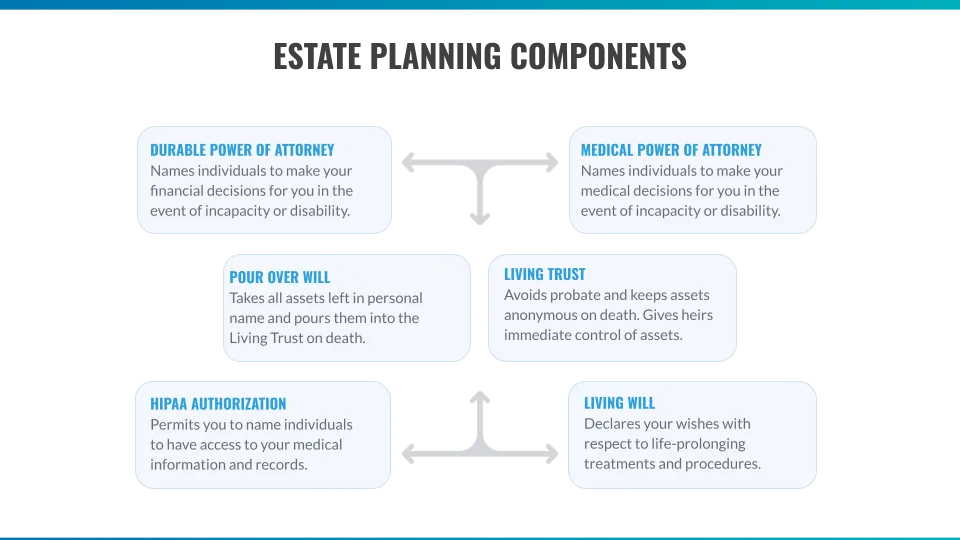

We’ll also help you employ different types of trusts to create anonymity at the County Recorder and Secretary of State offices, as well as during probate (so you look like a beggar on paper and can transfer your assets anonymously to your heirs).

My team can show you how to save $20k or more in taxes during the first year, and additional tax and legal structures will continue to reduce your taxes down to the 0-10% range. Without entities, this would be impossible.

Here’s a 20-year forecast that shows how the right combination of tax strategies, investing and corporate entity structure can grow your wealth:

Protect yourself from lawsuits with estate planning, no matter how unlikely you think they are, so that you don't have any major setbacks on your journey to time and financial freedom.

You’ve worked hard your entire life. It’s time to gain control over your time and money. Rapidly achieving true freedom requires a good tax and investment strategy.

We help tech executives and other professionals in the digital space save $20k or more in taxes during the first year—then re-invest that tax savings into turnkey properties, ATMs, self-storage syndications, apartment complex rehabs and more. We help them create the right tax and legal structures to continue to reduce your taxes and create true anonymity to protect their money.

In the end, we can help you:

Scott Royal Smith is an asset protection attorney and long-time real estate investor. He's on a mission to help fellow investors free their time, protect their assets, and create lasting wealth.

Ready to know more than your attorney? Join our community platform where you'll get immediate FREE access to all our best educational resources for real estate investors. Including 8 Masterclasses, group mentoring replays, and much, much more.

Join thousands of real estate investors in all 50 states as they enjoy exclusive content, special promotions, and behind-the-scenes access to me and my guests. No spam, ever. Just great stuff!